|

|

January 2022 Newsletter |

|

Welcome to the JANUARY edition of Suburban Real Estate News. 2021 the year that inflation reared its ugly head. Nearly everything in 2021 cost more than 2020, not just real estate. While supply-chain disruptions, labor shortages and fiscal stimulus have all been blamed for the rise in short-term inflation, another long-term force is de-globalization. As for real estate, housing bulls on Wall Street argue that this is an upturn that could last for a decade. Millions of millennials are now at a point in their lives when they are seeking single-family homes in the suburbs and exurbs. They are entering a market still chastened by an unprecedented collapse in housing more than a decade ago. As for rate hikes, Byron Wien of Blackstone suggests that "The economy is extremely strong. Almost every parameter you look at from employment to capital spending to small business, purchasing manager indicators, the economy is roaring ahead. I don't think a recession is imminent. If the economy maintains its momentum it can withstand several rate hikes”. As for local real estate, 2021 started the trend of off market real estate. Agents brokering private sales has been more popular than ever. Experienced local agents have been very successful in getting these to fruition and with the lack of faith in Zillow, buyers are turning more often to local agents for their support and experience. Here are some notes from Morgan Stanley’s 2022 Economic Forecast. These are 4 trends that could further drive higher-than-expected growth and inflation, with greater capital spending and improving productivity: 1. Innovation: During pandemic-related shutdowns, service businesses were forced to innovate digitally, spurring investment and an explosion in start-ups, as well as historic levels of public and private market activity—from fintech and cryptocurrencies to autonomous vehicles and artificial intelligence. 2. De-globalization: supply-chain localization started before COVID amid U.S.-China trade tensions. Today’s inflation-driving supply imbalances and inventory shortages not to mention increasing sensitivity around cybersecurity, public health, geopolitics, and shifting regulatory frameworks in China have all added momentum to this trend toward domestic sourcing. 3. Decarbonization: The pandemic and related business closures led to reduced fossil fuel consumption and carbon emissions and intensified pressure against investment in such energy sources. This is a reality that’s adding to cost pressures and could continue to support inflation levels. 4. Transformation of the U.S. labor market: A labor crunch driven by workplace safety concerns and accelerated retirements, coupled with employees’ seeking new leverage to change jobs or demand higher wages, could continue to drive higher labor costs for companies. This, in turn, could weigh on profit margins. Bidding Wars, who is competing in them? The Millennial vs The Baby Boomer A new challenge has emerged throughout the real estate markets worldwide: Many smaller, more affordable entry-level homes have two audiences, not just the obvious younger, first -time home buyer but also the retiring and down-sizing. Baby Boomers are competing with first time home buyers for the same properties. The biggest challenge is that the Boomers often have the better finances as a result of a lifetime of work and savings to offer more appealing financial profiles to sellers, often all-cash offers. More challenging is that to downsizing baby boomers paying over the asking price is more easily achieved often the smaller, cheaper homes appear really cheap when compared to the large home they may have just sold and knowing they are older and time is the last luxury, they are not in a wait-and-see mode: they want instant gratification, even if it costs more. Plus many are buying two or even three lesser priced homes in multiple parts of the country to maximize their retirement years. And selling a big house makes this more easily affordable for many. The Millennials have started being the beneficiaries of the great wealth transfer via inheritance or gifting worth $68 trillion, which further compounds the bidding war between them and the Baby-boomers. It could take at least a decade to catch up with US under-building, and it may take even longer to catch up on the more affordable entry level homes as many builders prefer building luxury homes. Unfortunately, its only time that will reveal whether extreme pricing escalations are a temporary blip or a permanent, justifiable result of real supply-demand issues that always raise pricing. What we will see in 2022 Catch up markets - Sometimes when markets slow, those with the 'demand' don't disappear, they simply are in 'wait-and-see' mode. Those buyers are done being on standby and ready to enter the marketplace. Snowballing - in the frenzy of missing out on numerous multiple bid scenarios, people start to bid higher out of desperation to just be done with the process. This can create new baseline pricing going further. It is still cheaper to buy now than in 2018 even with increased pricing as rates are still lower. New audiences, buyers have relocated. Much of the buyer audience in many areas are brand new audience in the past 18 months, moving from other higher costs states like NY to places like Florida, Texas & North Carolina where pricing appears to be relatively cheap. With higher incomes and higher home price expectations, this audience pays up therefore increasing that market’s local pricing. Looking purely at supply-demand ratios, the decade-long under-building in the US of millions of homes combined with the massive increase in wealth amongst the wealthy should support pricing for some time. Add in elevated inflation and these higher prices are probably here to stay, although escalations are bound to moderate to more normal levels. |

|

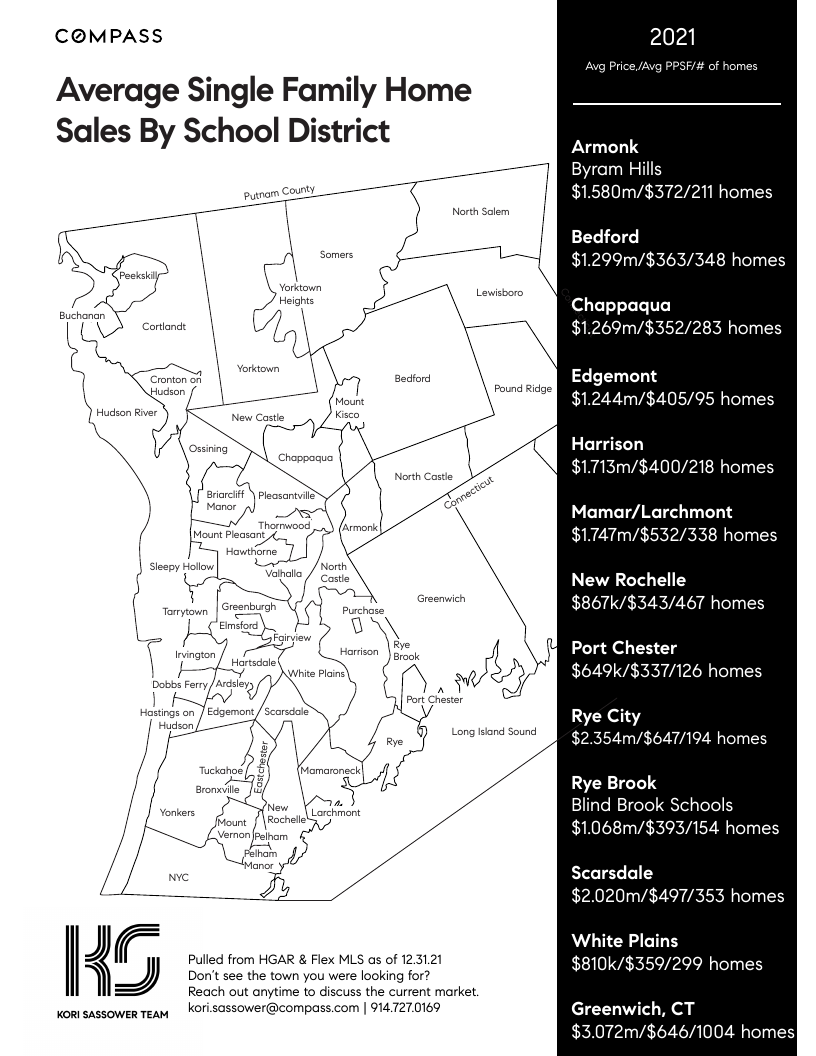

How the year shook out in some of your favorite towns. |

|

|

How do the Towns Compare to 2020? |

. |

|

CNN Article "The housing market was on a wild ride this year. Here's what to expect in 2022" Will rising prices, tight inventory and all cash offers continue? Click HERE to read the article. |

|

Want to see how the celebs live? The 10 Most Expensive Celebrity Real Estate Transactions of 2021. Click HERE to see them. |

|

Let 2022 Be Your Best Year Yet! |

|

Remember to Dream Big, Move Fast, Learn from Reality, Be Solutions Driven, Obsess About Opportunity, Collaborate Without Ego & Bounce Back With Passion. |

|

Please click below to watch our end of year wrap up. |

|

Connections across the country |

|

With so many buyers moving all over the country, weekly I am constantly connected to the best agents in all the top markets. Hamptons, Florida, Texas, North Carolina, Cali, Nashville. In addition, I have amazing referral partners with my local neighbors in NYC, Brooklyn, CT, NJ, MASS. Please reach out if you are also exploring these areas and I can get you in touch with the right agent. Check out this marketplace convo from Christopher Covert in our Hampton’s Office where he discusses the market out East. Click Here to Read More. |

|

MY LISTINGS |

|

|

Happy New Year! |

|

|

|