|

|

S u b u r b a n N e w s J u l y 2 0 2 2 |

|

|

Welcome to the July 2022 edition of the Suburban News. There has been a meaningful slowdown in buyer demand. We are experiencing a reset for a more balanced market. In a balanced market; buyers tend to place reasonable offers on homes and sellers tend to accept them. Homes remain on the market for a moderate amount of time (typically 4-6 months) neither lagging for months nor getting snapped up in mere hours or days. Home prices remain stable or grow at a steady pace. With fewer people looking to buy, inventory will eventually inch up. Some predict that if sellers don’t want to lower their list price, they will pull their inventory off the market and decide to rent it out instead. Will this cause rental prices to surge even higher? The .75 percentage point increase in interest rates was the impetus for this slowdown. Would efforts focused on fixing the supply chain be more effective than raising rates? Some believe that solving the supply chain and war issues will have a far greater impact on reducing inflation in a supply-demand world and economy. "Concentrated rate hikes in 1994 set up the U.S. economy for the stellar performance in the second half of the 1990's with strong growth and a healthy labor market. A lot of good things happened in the second half of the 1990s, and I hope we can get something like that this time,” - James Bullard, St. Louis Fed Chief. On the topic of recession fears, Powell changed his tune regarding a "soft landing," which means the Fed can slowdown or tighten the economy in their attempt to bring inflation under control while avoiding a recession. He acknowledged that pulling off a soft landing would be "very challenging" and that a recession is "certainly a possibility”. According to Capital Economics, property prices could contract an annual 5% by the middle of next year. Previous projections had indicated no change in values by that time. Real estate is HYPER-LOCAL and the press & media usually lag a few months on what we are seeing right now in your local market. The markets with no state income tax and favorable weather conditions are still doing well. The areas that are dominated by tech industry employees are having a housing pause due to layoffs and stock loses. The Westchester and Fairfield County markets are still experiencing pockets of multiple biddings while other homes are getting price reductions for the first time in a long time. Favorable pricing and homes in modern move in condition are still the drivers for homes that are selling faster. We have seen more buyers walk away from deals at the 11th hour than we have ever seen before for no real reason. One looming fear that may effect supply would be a seller strike - the sellers who bought their home when interest rates were at 3% may now be hesitant to list their home knowing that when they buy again it will be at a much higher rate. Price reductions…. When a seller considers a price reduction to help match the monthly mortgage payments of lower rates, this is how to adjust: - A 6% mortgage rate monthly payment is equal to a mortgage payment with a 5% rate when the asking price is reduced by roughly 8.25%. - A 6% mortgage rate monthly payment is equal to a mortgage payment with a 4% rate when the asking price is reduced by roughly 16.25%. Remember, if a home price has risen 20% in the past year, a 10% price reduction erodes 12% of that 20% gain. T he good news is if the market rebalances, buyers will be able to afford the homes on a monthly basis the same way they did last year. When a recession starts, rates go down. Buyers who are getting a temporary or adjustable-rate mortgage which has a much more desirable rate, will refinance to a fixed mortgages as rates go down. Happy to discuss more in detail about your housing options. |

|

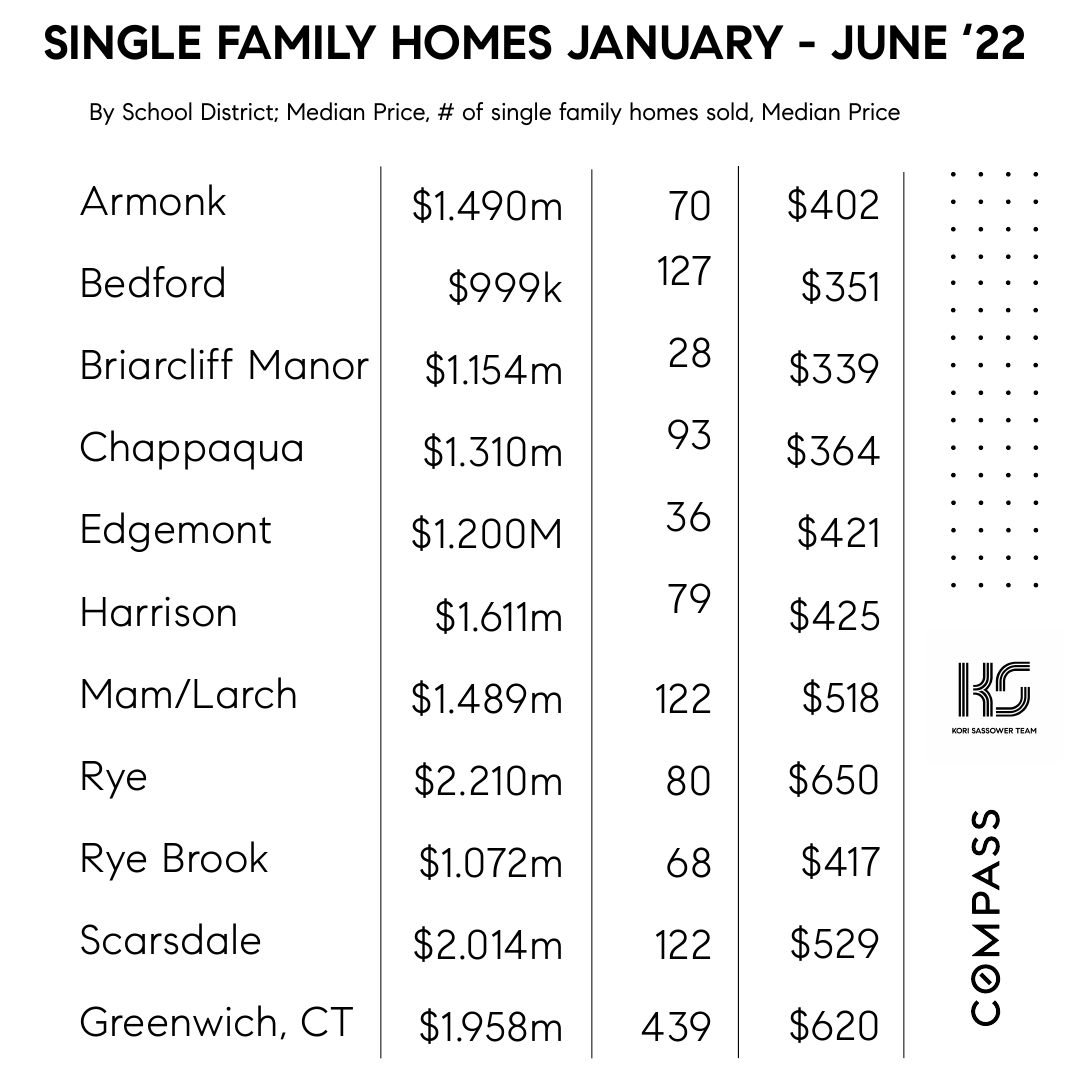

Year to Date Stats by Town |

|

|

What's on the Market for around $2m? |

|

|

MY ACTIVE LISTINGS |

|

|

Did you know….. The price of a classic CHANEL quilted handbag has DOUBLED in the past 5 years, talk about LUXE-flation! The luxury industry has raised prices for the past 5 years. Certainly makes the housing market seem BETTER. |

|

|

|

|

|