|

|

|

June Market + Economic Update 6/30/2022 We are excited to announce we'll be collaborating with Mark Sauer, from AllOneWealth to provide an economic update with valuable information, industry insight, and professional guidance on the latest key trends. Mark is the Founder of AllOneWealth, a conscious investing, wealth management firm which melds the worlds of capitalism and social responsibility. His background in finance, blockchain, technology, and impact investing has resulted in his advisory of several impact-oriented enterprises where he aligns founder’s visions with profitable business practices. As well as, thoughtfully guiding individuals, families and institutions when investing for retirement, legacy, and capital expansion. |

|

State of the Market: |

|

|

As we enter the Summer, buyers are constantly asking us "what's going on with the market? Is now a good time to buy?" And the answer often depends on the buyer, the property and the location. The past two years have seen record appreciation in the hottest sellers market of the past four decades. While stocks are down, Los Angeles real estate is up, although the market is not as hot as it was several months ago. While each neighborhood is its own hyper local market with unique dynamics, this month the Los Angeles real estate market has softened as a whole. More inventory has come on market and with the rate hikes (even though the past 48 hours have seen rates decrease) buyer appetite is beginning to cool. With the average rate in Los Angeles county, on a 30 year fixed in the mid to high 5% range, buyer's purchasing power is decreasing. That being said, rates are still quite low when compared with rates over the past two decades. We are seeing less fierce bidding wars than we saw in March, where a hot property could fetch 20 offers "at ask" or above after the first open house. Even though the action is slowing, prices across the board have yet to reflect a softening market. Well priced properties continue to trade for near-record prices, although the market is in its initial stages of plateauing. Enjoy your long holiday weekend, Adam |

|

|

|

Mark's Take on the State of the Economy: We’re now entering one of the more severe moments of this year. Market sell off, -5% last week with more losses coming in today. Inflation increasing despite rate hikes and the Fed’s promise of a ‘soft landing’. Energy cost at all-time highs with the national average at the pump now over $5/gallon for the first time ever. And the war in Ukraine showing us our dependence on a global economy for commodities. Bitcoin, and the entire crypto market, now suffering heavily. The survival of tokens, coins, and other digital currencies will largely depend on utility in the coming months. Heavily speculative aspects of the market will likely continue to suffer massive losses. Allocation is king during times of systemic fear. Seeking out companies who create true an inherent value for society is always the best route – but now more than ever. Below is your Monthly Market & Economic Update by the numbers. Interested in learning more about markets, inflation, QE or how you can take advantage of current investment opportunities? Schedule a call with us. Warmly, Mark & Adam |

|

Market Update |

|

|

|

Global Equities: |

|

Fixed Income: 10-Year Treasury yields were volatile again this week, briefly revisiting 3.0% just a week after hitting 3.5%. The 10-Year ended the week at 3.13%. High yield bonds were able to at least temporarily break out of a brutal downtrend, gaining 1.3% during the week. Buyers remain skeptical of taking on credit risk with rumblings of a potential recession growing. High yield bond mutual funds and ETFs had outflows of $2.6 billion during the weekly period ended June 22nd. |

|

|

Commodities: |

|

Westside Market Stats: |

|

|

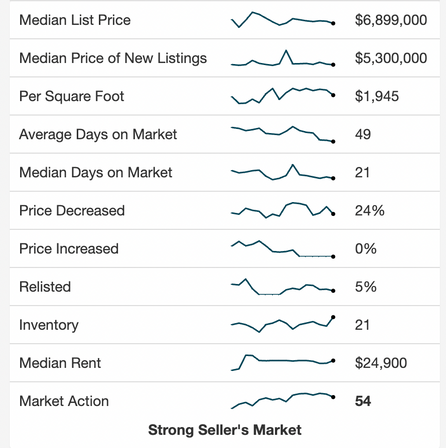

Santa Monica, CA 90402 |

|

This week the median list price for Santa Monica, CA 90402 is $6,899,000 with the market action index hovering around 54. This is less than last month's market action index of 55. Inventory has increased to 21. Market Action Index This answers “How’s the Market?” by comparing rate of sales versus inventory. |

|

|

The market has started cooling and prices have recently plateaued. Since we’re in the Seller’s zone, watch for changes in MAI. If the MAI resumes its climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices. |

|

|

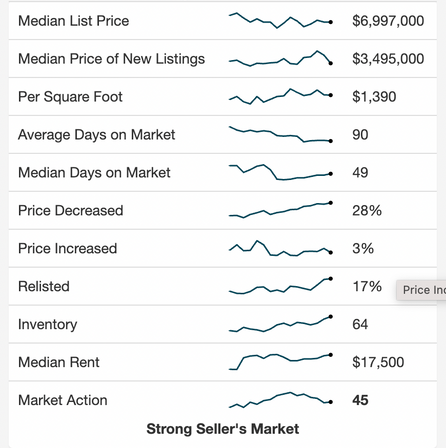

Los Angeles, CA 90049 - Brentwood |

|

This week the median list price for Los Angeles, CA 90049 - Brentwood is $6,997,000 with the market action index hovering around 45. This is less than last month's market action index of 47. Inventory has increased to 64. Market Action Index This answers “How’s the Market?” by comparing rate of sales versus inventory. |

|

|

The market has been cooling off a bit in recent weeks, as more homes are available and demand is less. We’ll be looking for a persistent downward trend. If we see a persistent trend, especially if the MAI falls from the Seller’s Market zone to the Buyer’s Market zone, expect downward pressure on prices. There is already some evidence prices moving lower. |

|

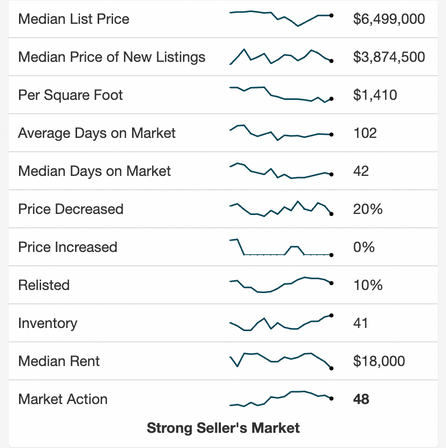

Pacific Palisades, CA 90272 |

|

This week the median list price for Pacific Palisades, CA 90272 is $6,499,000 with the market action index hovering around 48. This is less than last month's market action index of 51. Inventory has increased to 41. Market Action Index This answers “How’s the Market?” by comparing rate of sales versus inventory. |

|

|

The market has started cooling and prices have recently plateaued. Since we’re in the Seller’s zone, watch for changes in MAI. If the MAI resumes its climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices. |

|

|

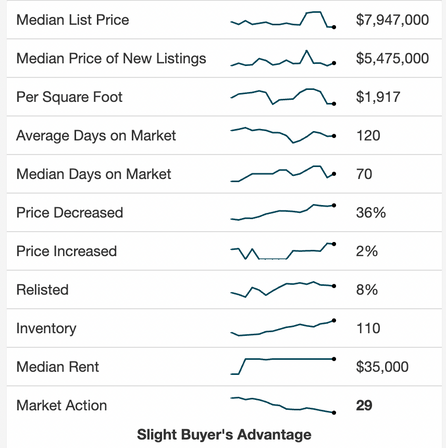

Malibu, CA 90265 |

|

This week the median list price for Malibu, CA 90265 is $7,947,000 with the market action index hovering around 29. This is less than last month's market action index of 31. Inventory has increased to 110. Market Action Index This answers “How’s the Market?” by comparing rate of sales versus inventory. |

|

|

The Market Action Index has been trending lower for several weeks while prices have remained relatively stable. If inventory continues to grow relative to demand however, it is likely that we will see downward pressure on pricing. |

|

Off-Market Investment Opportunities |

|

1838 20th St | Santa Monica - 4.4% Cap Rate A rare income opportunity @ 4.4% projected cap in the heart of Santa Monica! Completely renovated building - this exceptional property, offers you tons of flexibility - bring new tenants at market rent, or live in one of the units and rent the others for passive income! Reach out to learn more. |

|

1341 Yale St | Santa Monica - 4.07 Cap Rate The property is very well-positioned in the epicenter of Silicon Beach, Southern California’s most dominant employment hub. Rare opportunity to acquire 1341 Yale Street in Santa Monica, California, a ten-unit, two-story, garden-style apartment building neatly positioned just a half block north of Santa Monica Boulevard. Message me to find out more. |

|

|

Featured Listings |

|

|

"Service to others is the rent you pay for your room here on earth." Muhammad Ali |

|