|

|

S U B U R B A N R E A L E S T A T E N E W S A P R I L 2 0 2 2 |

|

|

Welcome to the April 2022 edition of Suburban Real Estate News. Will it ever get warm. For some reason this year, it feels it is taking forever to finally feel like Spring. In the housing market, what typically is the busiest buying season “spring market” started in January and is not showing signs yet of cooling off. Interest rates are rising, and that is moving some buyers out of the marketplace, but we are still seeing home prices soar. The home that may have gotten 20 bids in Jan may only be getting 10 now, but the prices they are garnering are just as high with favorable seller terms. Buyer fatigue has set in for many and some buyers are ready to take a break, but as new and exciting inventory is sure to come on, I am very confident those buyers will rest and come right back. What a buyer can afford has decreased as interest rates continue to raise. We are seeing buyers recalibrate their home search prices based off these new interest rates. There has been speculation that the inflation surge would be temporary as a massive, unprecedented, unprepared for resurgence in demand outstripped supply causing pricing to surge in almost all areas of the economy. They speculated that once production had been ramped up, prices would moderate and even come down. But that has not happened and many now speculate that higher inflation is here to stay for an extended period of time. Here are some of the reasons why: 1. Too much money at very low interest rates has been circulated into the economy. 2. Supply chain disruptions persist. 3. The economy needs more affordable labor. 4. Greenflation: our desire for cleaner energy - and government policies to accelerate this - has caused cuts in production of fossil fuels and nuclear energy, causing energy prices to rise. 5. War-flation, The Ukraine-Russia War has taken a tough situation and made it notably worse cutting supplies of oil, gas, grains, etc. that have had ripple effects globally. 6. Foreign made components are in everything. Just one missing part slows down production. In this high demand environment which is swimming with capital, someone will pay more for quicker service, thereby raising prices. 7. Tariffs on imports are well intentioned mechanisms to encourage production of certain things locally. But when a 17.9% tariff is applied to lumber imports from Canada - when the US cannot meet lumber demand - all lumber costs more therefore, building a home costs more so the consumer pays more. Click HERE for more on this topic. Boomers Retire, Developers Bet on Urban Senior Living Luxury retirement communities many with rooftop pools, celebrity chefs and spa-style wellness centers are planned for major U.S. cities. Homes of the Future, What's Planned From high-tech places for getting active to spaces devoted entirely to other dimensions, here are some of the rooms that could become must-haves in homes of the future. Click HERE for the full story from the WSJ. HOA’s are fighting back Small groups of neighborhood volunteers are blocking companies from buying single-family homes, rewriting homeownership rulebooks to thwart investor purchases of suburban housing. Restrictions on short or long-term rentals is one way to prevent HOA’s to be filled with investor properties. Whiteout There are several properties that are very well served by a simple coat of white paint. Some properties have all sorts of colors and unless they are extremely current and tastefully applied, they can look dated. Worse, even the most beautifully colored rooms can distract future buyers's ability to see their future in a home. Neutralizing a home is often the best course of action. Popular colors such as; China White, Decorator’s White, White Dove or Chantilly Lace do the trick. Crypto is real! Get ready to see this more! This listing is "accepting cryptocurrency in exchange for this property. If a buyer were to purchase the property using cryptocurrency the digital currency would be transferred directly to his seller". This is already happening right here in Greenwich! Energy prices are too high! Soaring oil and gas prices may fuel a surge in retrofitting existing homes for energy efficiency and/or self-sufficiency. Sorry Millennials, Gen Z the new obsession Gen Z, the demographic born between 1997 and 2012 will become an important contributor to the recent spikes in rental demand around the world as this generation starts to leave their homes after a 2-year stall, head to college and now head to work. Yes, while Millennials have been our obsessive focus for years, now GEN-Z is making its mark in the housing world. Generation Z consists of about 65 million people, 40% of US consumers were GenZers in 2020, As unemployment rates sink, they have entered the workforce en masse. Here are some Gen Z Stats; 69% of find ads disruptive. their span is 8 seconds, 55% use their smartphones for 5 or more hours daily, 60% are more likely than any other generations to hang up the phone if a business doesn’t answer in 45 seconds, 85% learn about new products on social media. According to these studies; Generation Z is the most diverse generation in history. They are creative, fashionable, technology-influenced young people. They are an optimistic, eco-friendly group that care about the planet. They are impatient, money-driven, and dependent on technology. |

|

What can you get for 2M? |

|

|

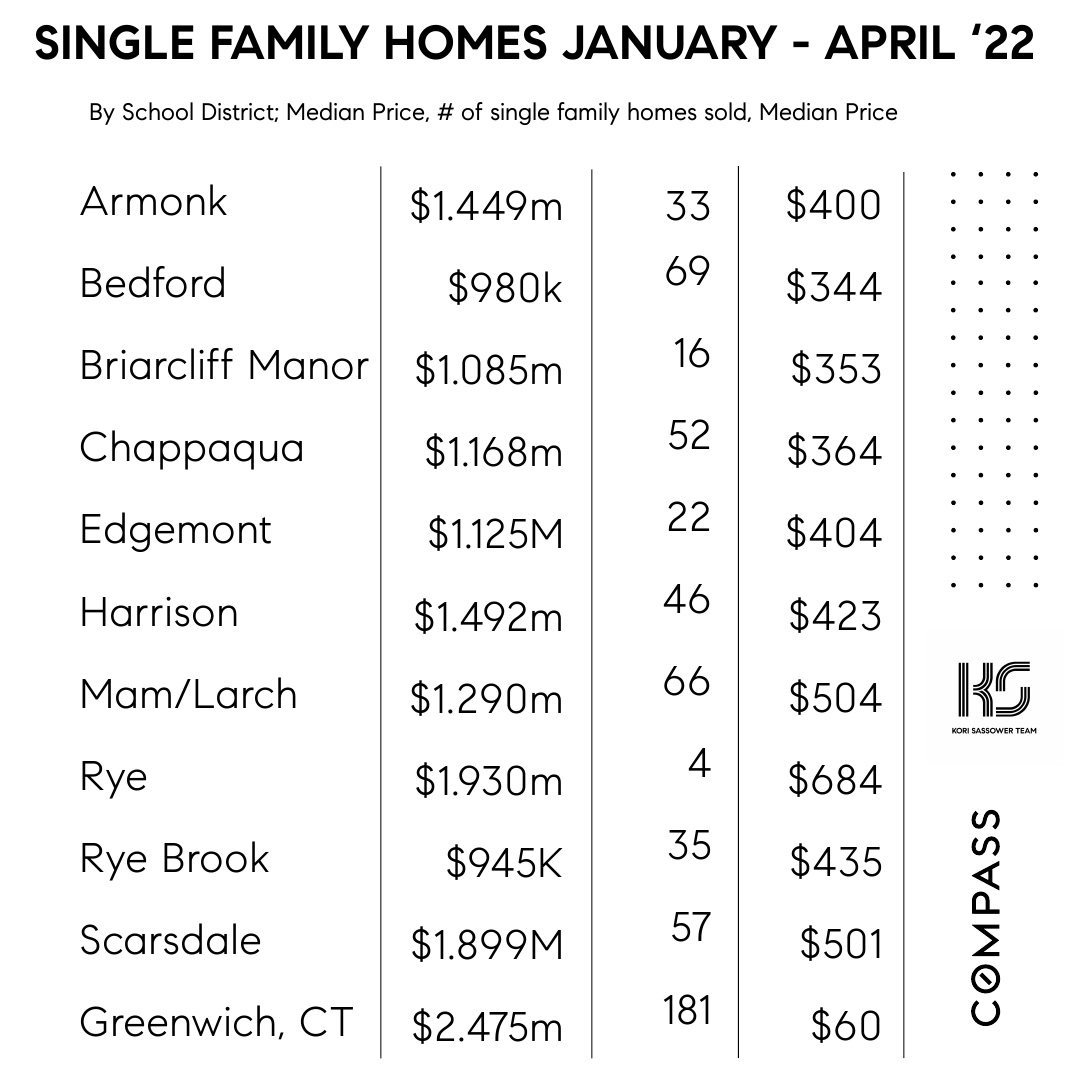

Q122 Local Market Reports |

|

|

MY ACTIVE LISTINGS |

|

|

Contest Alert! #COMPASS IN BLOOM |

|

5/5 - 5/8 take a photo in front of the COMPASS Rye Brook Office; there you will find the very colorful very oversized and super unique Kravets Flowers Display. Tag @korisassowerteam and one lucky winner will get a $300 Visa Gift Card. It's going to be AMAZING. |

|

|

|

|

|