|

|

S u b u r b a n N e w s A u g u s t 2 0 2 2 |

|

|

Welcome to the August 2022 edition of the Suburban News. While we experience some of the negatives of the current higher interest rates environment, maybe we are also witnessing one of the more important recoveries in the housing markets: the recovery of some inventory levels.

The extreme imbalances in many areas around the country and the world between supply and demand have been one of the key drivers of inflation. In many parts, we have seen unrealistic, irrationally exuberant double-digit price escalations in a very short period of time. This is unsustainable. “We’ve squeezed a decade of home price appreciation into a year and a half.” - John Burns Real Estate Consulting. Now we are seeing price cuts or more realistic asking price. While extreme price escalations upward always end, so do extreme price declines. In this under-built environment, with many builders and developers cutting back production, it would be unwise to expect prices to drop dramatically.

When the markets recover, we could see further price escalation as the extreme decade-long under-building is exacerbated during these moments of uncertainty. Any current inventory escalations may be viewed as a moment of opportunity for buyers. The demands on housing are here to stay and will continue to grow. All markets are driven by supply and demand, and we can be 100% certain that the over demand for housing will be highlighted yet again. A Big Reason for Inventory Shortage Fewer homes will trade as some sellers will not want to lose their low interest rate mortgage. If they locked in at 3%, why would they sell to then buy again and lock into an interest rate 2 points higher. These sellers are staying put, especially as home prices are declining. Rising interest rates and fear of a looming recession means home builders are already starting to pull back construction. The stagnant flow of buying plus no new construction will create a major inventory shortage. There will not be sufficient inventory for the tens of millions of millennials looking to buy a house over the next decade. Fully Furnished More homes are selling fully furnished than ever before. The convenience of buying everything including furnishing has become more appealing. Some don't have the time or inclination to go through the process. Some want instant gratification. Some with a lack of imagination love buying what they can see in the home, placed, and purposed, something they can touch and feel. Did you know? After Memorial Day weekend, demand for mortgages hit a 22 year low. 2nd Home Buyer? Owning a 2nd home is expensive yet renting it out for a few weeks offsets this expense and sometimes even delivers profits! 2 weeks’ worth of home rental income is not taxed either, under the '14-day rule' you don't pay tax on income you earn from the short-term rental, as long as you: Rent the property for no more than 14 days during the year AND use the vacation house yourself 14 days or more during the year or at least 10% of the total days you rent it to others. $14,000 of tax-free income can pay for a real estate tax bill, yard maintenance, etc. The Entry Level Buyer Is Under Attack! In most areas around the country, the consumer seeking entry level priced homes is starved. Too many builders have chosen to build more expensive and more profitable homes. Now, as rents rise delivering stronger returns, and the lower-price-point buyer loses buying power with higher interest rates and focuses on renting instead thus placing additional upward pressure on rental prices. A 3% annual rent escalation amounts to rent more than doubling over 30 years. The Big Canceler We have seen a growing number of buyers pulling out of deals before contracts are signed. The sensationalism in the news is spooking many of these first-time buyers. The backup buyer who maybe did not waive all their contingencies or offered what they felt was a fair market value price seems to be the big winner. When the 1st buyer backs out, they are waiting in the wings grateful and excited. While too many people spend months and years timing markets, the clock of life does not stop ticking. Time is the last luxury and an investors best friend at times, especially when time fuels compounding value/wealth creation and the ability to live in and enjoy your investment that is fulfilling an essential need. |

|

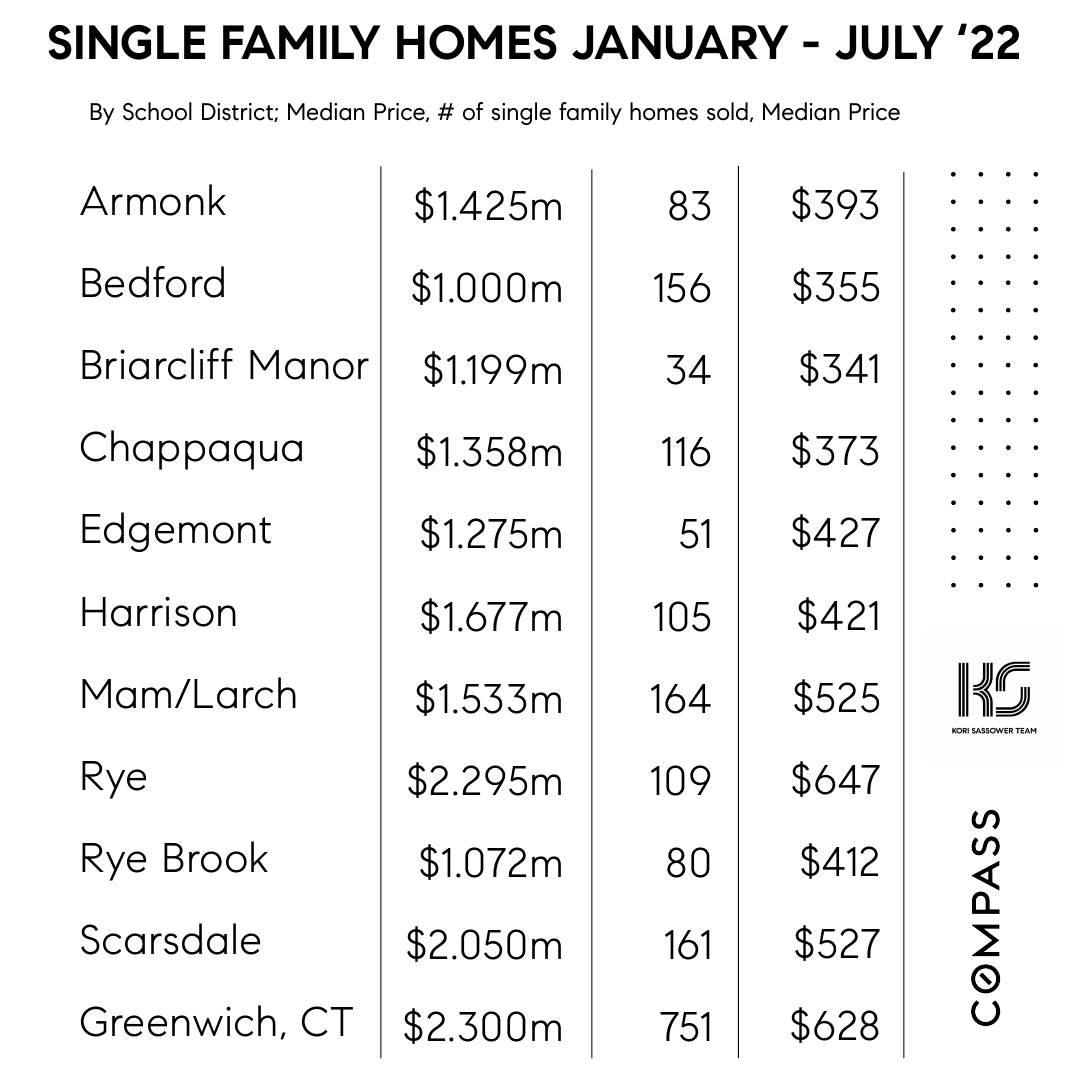

Year to Date Stats by Town |

|

|

What's on the Market for around $3m? |

|

|

MY ACTIVE LISTINGS |

|

|

|

|

|

|