Cristian Lavin

Specialties

Education

Before joining Compass, Cristian was the Regional Vice President for the East Coast at a multinational car rental company. In this role, he demonstrated exceptional leadership by developing new locations, securing commercial real estate, negotiating leases, managing retail construction projects, hiring and training staff, driving business development, and overseeing daily operations. This experience honed his expertise and expanded his professional network across the United States.

Cristian's extensive experience ensures that his clients achieve their real estate goals, whether buying or selling. By partnering with Compass, a tech-driven real estate brokerage, he effectively utilizes advanced technology resources and the company's national exposure to better serve his clients.

Cristian holds an MBA from the University of Miami and a degree in International Trade and Finance with a minor in Economics from Louisiana State University. Outside of work, he leads an active lifestyle, enjoying walks with his golden doodle Ted, hiking, weightlifting, and playing basketball. A true foodie, Cristian loves exploring new restaurants in South Florida and the Bay Area. He is also an avid reader and fluent in both English and Spanish. Learn more

Bay Area Luxury Market Report

So far in spring 2024, the Bay Area has been seeing its strongest luxury home market since the spring 2022, the very heated end of the pandemic boom. Still, luxury market indicators are generally cooler, and sometimes much cooler, than more affordable segments - though this is not unusual by long-term standards.

Market dynamics, trends, values, and property characteristics vary between counties and between submarkets within counties, but correct pricing, preparation, marketing, and pristine, updated move-in conditions are almost always critical to buyer response in the luxury market.

Reflecting house, townhouse, condo, co-op, ranch, and vineyard (with house) listings and sales reported to NorCal MLS Alliance. Statistics should be considered approximate, comparative indicators instead of exact measurements, and how they apply to any particular property is unknown without a specific comparative market analysis. Data from sources deemed reliable may contain errors and are subject to revision. All numbers are approximate.

Marin County Market Report

- The 3-month rolling median house sales price in May rose 4% year over year to its highest value since mid-2022.

- The number of active and coming-soon listings on 6/1/24 was 36% higher year over year and the highest count in over two years.

- The number of home sales and luxury home sales in May 2024 hit their highest monthly counts since mid-2022.

- Over 50% of home sales in May were over the asking price, and the average home sold a little above 2% over the asking price.

30-year-loan interest rates hovered around 7% in May and early June, which many buyers and sellers have clearly accepted as the new normal. (And an estimated 30% to 40% of national homebuyers have been paying all cash.) Stock markets once again hit new all-time highs, with a substantial effect on household wealth. It is common for home listing and sales activity to slow in summer.

The report was created in good faith with data from sources deemed reliable but may contain errors and is subject to revision. Last-period figures may change with late-reported activity. All numbers are approximate. Mortgage interest rates vary according to the property, price, borrower, and lender. Economic conditions can be subject to significant volatility, even over the short term.

San Francisco Market Report

- The 3-month-rolling median house sales price in May, at $1,735,000, hit its highest value since mid-2022. The median condo sales price, $1,135,500, declined about 1% year over year.

- Year over year, 2024 YTD home sales volume was up about 12% from 2023, while luxury home sales of $5 million+ soared 62%.

- 82% of house sales and 44% of condo sales sold for over asking price in

- May.

- House sales averaged a sales price almost 13% over the asking price, while condos averaged a sale price about a half percent higher than the asking price. Both were the highest percentages since mid-2022.

- Average days on market were the lowest in 12 months.

30-year-loan interest rates hovered around 7% in May and early June, which many buyers and sellers have clearly accepted as the new normal. (And an estimated 30% to 40% of national homebuyers have been paying all cash.) Stock markets once again hit new all-time highs, with substantial effect on household wealth. It is not unusual for home listing and sales activity to slow in summer.

The report was created in good faith with data from sources deemed reliable but may contain errors and is subject to revision. Last period figures may change with late-reported activity. All numbers approximate. Mortgage interest rates vary according to the property, price, borrower and lender. Economic conditions can be subject to significant volatility, even over the short term.

National Real Estate Insights

Prices, Inventory & Sales Continue to Rise Moving Deeper into Spring.

Inflation & Interest Rates Fall; Stock Markets Hit New Highs.

- Year over year, the median single-family-home sales price in April 2024 was up 5.6%. The median condo/co-op price rose 5.4% to hit a new all-time high. Median home sales prices usually peak for the calendar year in late spring.

- The number of new listings in April 2024 was up 12% year-over-year, hitting its highest monthly quantity since mid-2022. The number of homes for sale increased 16% year-over-year to its highest count since autumn 2022, and should continue to rise in coming months.

* Monthly home sales jumped 11% from March, and rose 7% from April 2023. As a percentage of sales, listings selling for $1,000,000+ continued to climb, as sales below $100,000 declined.

• In April, approximately 68% of sales went into contract in less than 1 month, 27% closed over list price, and 28% were purchased all-cash. 82% of buyers purchased in suburban, small town, rural or resort areas. Only 2% of transactions were distressed-property sales (i.e. foreclosure or short sales). The median days on market to acceptance of offer declined to 26 days, and the average number of offers received for listings which sold increased to 3.2.

Virtually all the economic indicators that weakened in April turned around again in May (as of 5/21/24): The latest monthly inflation reading declined, stock markets rebounded vigorously to hit new highs, and interest rates dropped back down to where they were before their April jump.

Most market data from the National Association of Realtors® is under copyright and used with permission. A national report is a huge generalization of values, conditions and trends across thousands of different markets. Economic indicators are often subject to significant volatility. Data from sources deemed reliable, but may contain errors and subject to revision. Last period figures sometimes labeled preliminary, and all numbers to be considered approximate. May sales data becomes available in the 3rd week of June.

Compass Concierge

Honored to be included in RealTrends by closed sales, individual agent

Compass #1 Brokerage in the U.S. three years in a row

RealTrends Verified 2023

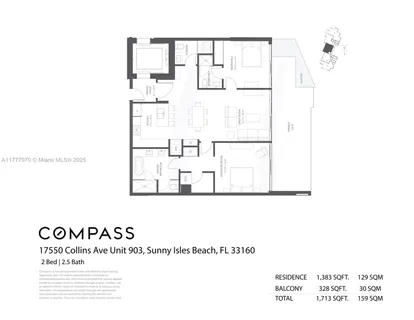

Cristian Lavin’s Listings

Cristian Lavin’s Transactions

$5,000,000

430 Grand Bay Dr, Unit 1101

Key Biscayne

$3,600,000

- Bedrooms

- 2

360 Ocean Dr, Unit 904S

Village of Key Biscayne

$3,090,000

379 Caribbean Rd

Key Biscayne

$2,650,000

- Bedrooms

- 2

350 Ocean Dr, Unit 305N

Village of Key Biscayne

$7,667

- Bedrooms

- 2

360 Ocean Dr, Unit 604S

Key Biscayne